The 0.1-Second Advantage: How to build blazing fast, enterprise Shopify e-commerce sites that don’t leave money on the table

A collaborative research study with Google found that a 0.1-second improvement in load time can lead to an...

How I operate as a 100x software engineer, and the mantras that get me there

The speed at which coding agents are improving, specifically over the final few months of 2025, has been...

The AI e-commerce infrastructure advantage most brands on Shopify don’t know exists yet

While most e-commerce brands debate ChatGPT implementations, a select group is quietly automating their entire customer experience. They’re...

How I taught myself to code at age 10 and sold my first startup at 14

“Well, you’re going to need a bank account” my mother said as she glanced at the stack of...

The e-commerce brand leader’s guide to AI: cutting through vendor hype

Every vendor from email platforms to inventory management has added “AI-powered” to their marketing. Some of it represents...

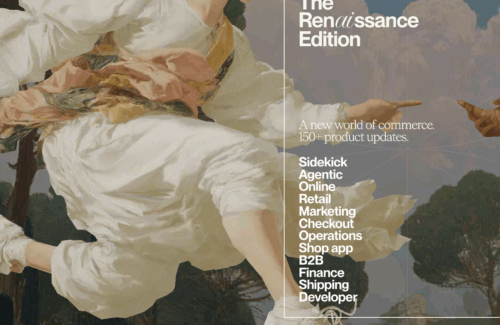

The biggest Shopify Winter ’26 Editions takeaways for mid-size and enterprise brands

We’re in a true technological renaissance at this moment in the age of AI, and Shopify continues to...

Ruthless prioritization & the unimportant

An ability to maintain laser focus, quickly realizing what’s important and what is not, is a super power...

A bias towards action: don’t talk about the work, do the work

In startups and tech, the most successful people in the room have an incredible bias towards action and...

How to hire and attract “10x” engineering talent

Engineers who can manage periods of sprinting and planning to prioritize high-level business goals in tandem with technical...